Making Tax Digital for Accountants: You've Chosen the Software. Now What?

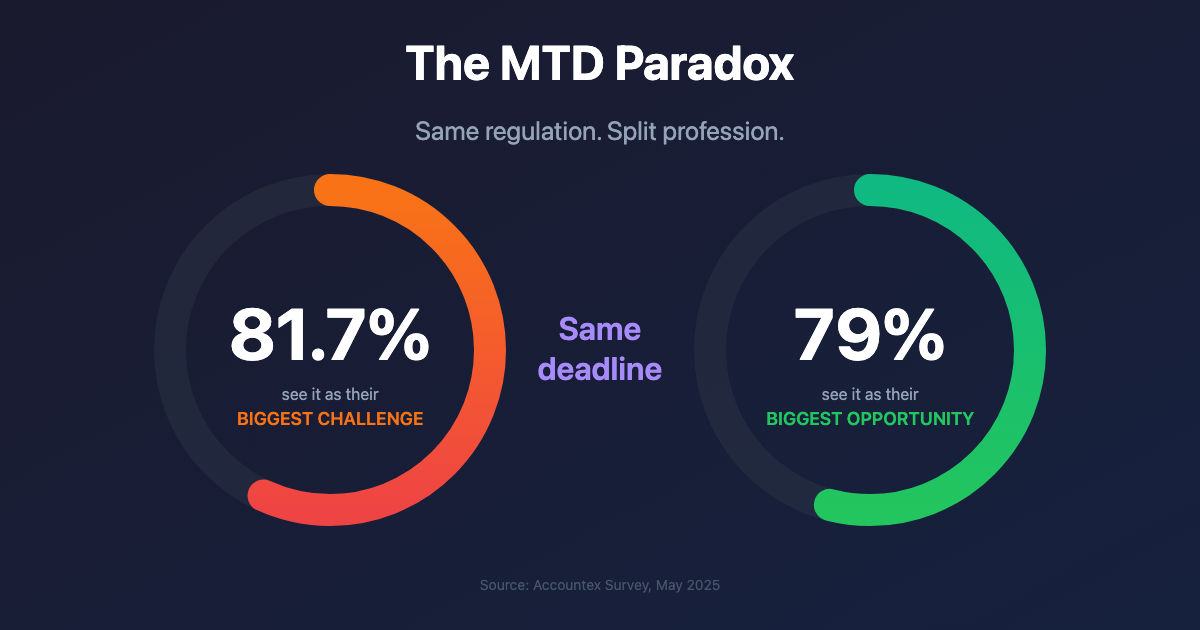

81.7% of accountants see MTD as their biggest challenge — but 79% also see it as their biggest opportunity. The compliance conversation dominates, but the harder questions are commercial: Have you repriced? Are you packaging MTD as a distinct service? Are you winning clients from underprepared competitors?

An Accountex survey (May 2025) found that 81.7% of accountants see Making Tax Digital as their biggest challenge — but 79% also see it as their biggest opportunity. That's a striking split. Same deadline, same regulation, and the profession is almost evenly divided between anxiety and ambition.

At Context is Everything, we work across regulated industries navigating complex change. We see this pattern repeatedly. The compliance conversation dominates — which software, which deadlines, which clients are in scope. That's essential work. But it's also the part that gets solved first, because it has clear answers.

The harder questions tend to surface later.

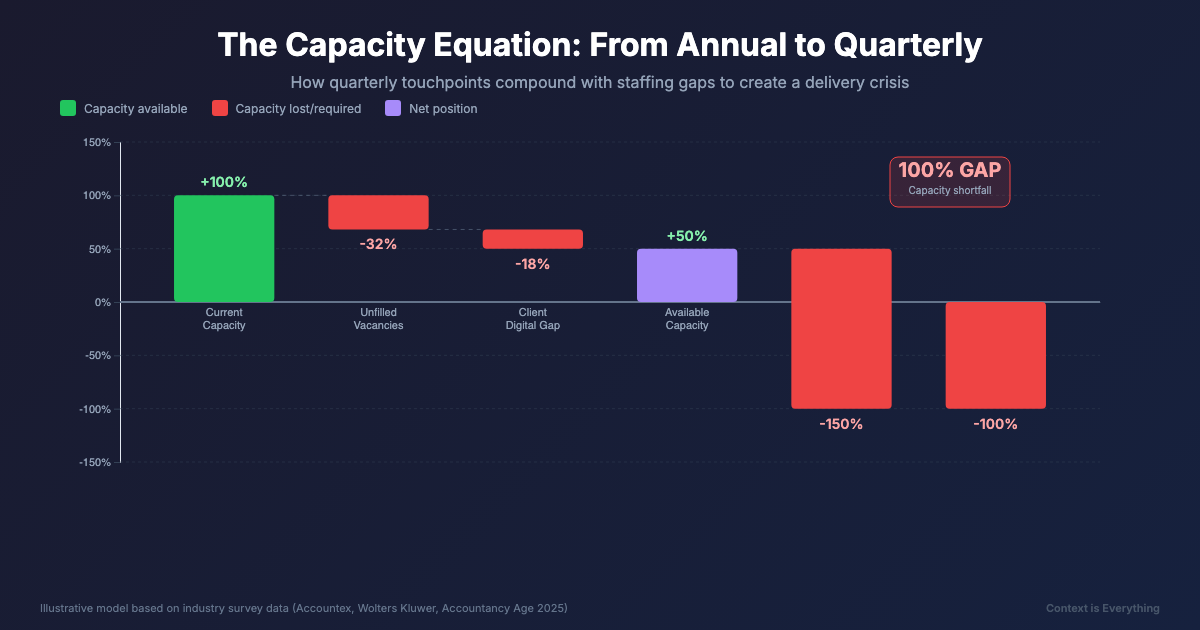

When any sector moves from annual to ongoing reporting cycles, it doesn't just change the workflow. It changes the client relationship, the fee structure, and the competitive landscape. The firms that recognise this early tend to come out ahead — not because they were more technically prepared, but because they treated the shift as a commercial event rather than a compliance one.

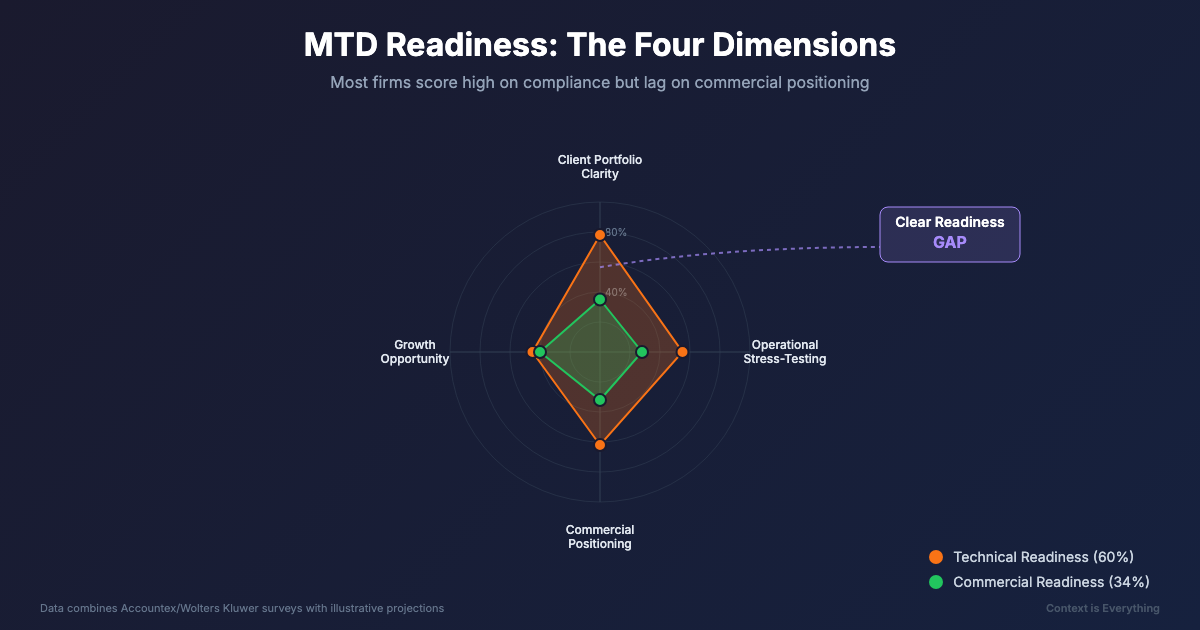

From what we're seeing in the data, there are interesting tensions. That same Accountex survey found 34% of accountants still feel unprepared — but even among those who feel ready, the conversation tends to centre on technical capability rather than operational capacity or pricing. Wolters Kluwer research (August 2025) found 42% of accountants say more than half their clients still aren't submitting data digitally — that's not a software problem at the practice end, it's a client change management project that needs resourcing.

Meanwhile, Accountancy Age data (2025) shows 68% of firms are carrying unfilled junior vacancies. Adding quarterly touchpoints across a growing client base, into a team that's already stretched, changes the economics of delivery — regardless of how good the software is. And your clients are already using AI to validate your advice, adding pressure from both directions.

The practices we'd expect to thrive aren't necessarily the most technically advanced. They're the ones asking a different set of questions: Have we repriced for the new cadence? Are we packaging MTD as a distinct service? Are we using this as a reason to reach out to clients at firms that aren't ready?

These aren't accounting questions. They're business model questions. And they're the ones that tend to get deferred until after the compliance rush — by which point the early movers have already repositioned.

April 2026 is the compliance deadline. The commercial window opened months ago. Your competitors are already moving.

---

Assess Your MTD Opportunity

Want to know where your practice stands across all four dimensions? Our free MTD Opportunity Assessment takes 5 minutes and shows you exactly where the gaps are — and where the opportunities lie.

Related Articles

Your Clients Are Already Using AI to Check Your Work - Here's How to Stay Ahead

39% of clients now validate accountancy advice with AI before acting. Discover how the confidence gap is holding firms back, and why the window for competitive advantage is closing fast.

Why Most AI Projects Fail (And What the 5% Do Differently)

MIT's Project NANDA found 95% of enterprise AI pilots deliver zero return. Companies have invested £30-40 billion with nothing to show. But 5% achieve rapid revenue acceleration. The difference isn't the technology - it's implementation and context.

5 Signs Your Business Actually Needs AI (And 5 Signs It Doesn't)

Most businesses don't need AI right now. Here are 5 signs you genuinely need it—and 5 signs you definitely don't. The honest assessment most consultants won't give you.